Here Are A Few Motives Why An Organisation Might Engage An External Cfo

Current growth is occurring, for example, adding new products or expanding into new markets. An outsourced CFO may have prior experience with similar markets, products or industries, and will be able to provide advice on strategy. Outsourced CFOs can help in managing costs, risk assessment, as well as maximising profits. An outsourced CFO has likely faced similar challenges to ones you face before and has the experience of being able to design and implement real-time, long-term changes.

Raising equity capital and debt. A CFO outsourcing service can assist in capital raising by offering strategy, due diligence as well as attending meetings to establish competence, providing advice on the most appropriate combination of equity and debt financing, and negotiation of conditions sheets. Maximize margins with an analysis of current costs and pricing arrangements. Your CFO can examine your financial records to identify improvements that could be made and help execute those improvements. Check out this outsourced cfo for more info.

Consulting And Advising On Strategy On A Part-Time Basis.

To scale systems to deal with the growing complexity of (financial, sales, or business systems) New or upgraded systems must be implemented. If a CFO who is full-time cannot be replaced or is currently being installed in the first place time, an interim CFO could be needed. They could choose to hire an interim CFO who will oversee the financial strategy of an business while they the search of a permanent one. Consult with an already-employed CFO. A lot of companies have an outsourced CFO. But, the CFO might not have had experience in solving particular issues or reaching particular goals (such the design of systems and raising capital.). An outsourced CFO may consult with the CFO and help them to improve the financial performance, enhance the overall strategy for financial management, or transfer important skills.

Providing A Financial Forecast.

Forecasts can be utilized for many purposes such as budgeting as well as fundraising. They also help to project growth and to plan for restructuring. An experienced Outsourced CFO will have extensive knowledge of forecasting and give a precise forecast based on your long-term goals.

What do I need to be a Controller? CPA?

While an Outsourced Controller is accountable for maintaining accurate financial records , while accountants and CPAs ensure that taxes and finances are in order with the law, a CFO provides financial strategies, insight planning, execution, and insight that are geared toward the future. Have a look a this outsourced cfo services for details.

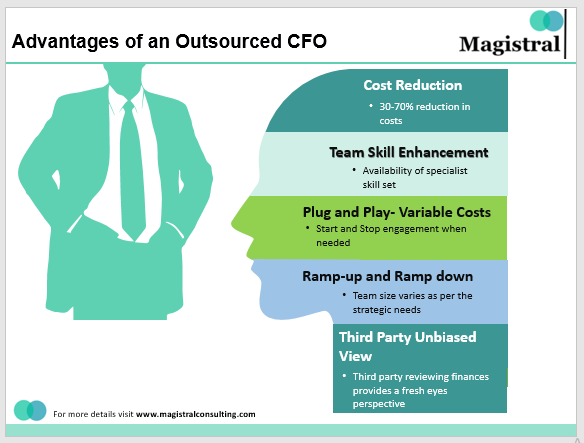

Why Outsource Your Cfo When You Can Have An In-House Cfo.

A CFO can assist every business develop a plan of action and fine-tune its operations, business relationships, and many other key skills. But not every company can afford or has the funds to hire a full-time CFO. The hiring of a full-time CFO typically comes with a salary that is annual and benefits. They can be prohibitive, especially when considering annual increases. To find a reasonable CFO, many organizations have to compromise their experience for a viable hire. When you choose to hire an Outsourced CFO However, your money "goes farther" because you're "sharing" the CFO and paying only for time and expertise that you require. CFOs who have extensive expertise can be hired at a similar monthly price (or less) and with no advantages or increases. You can also work with a CFO who is experienced in the specific challenges you are facing. CFOs who are outsourced typically have substantial expertise in projects and industries. They are also familiar with the problems faced by companies similar to yours and can assist you in solving the issues. The most efficient Outsourced CFOs are able to access the entire range of accounting and finance expertise which allows them to construct teams to help clients achieve their primary goals. One of the best benefits of an outsourced CFO is their ability deliver efficient, relevant teams that are scalable and have an array of expertise and, in certain cases, at a fraction of the price the cost of a full-time CFO.